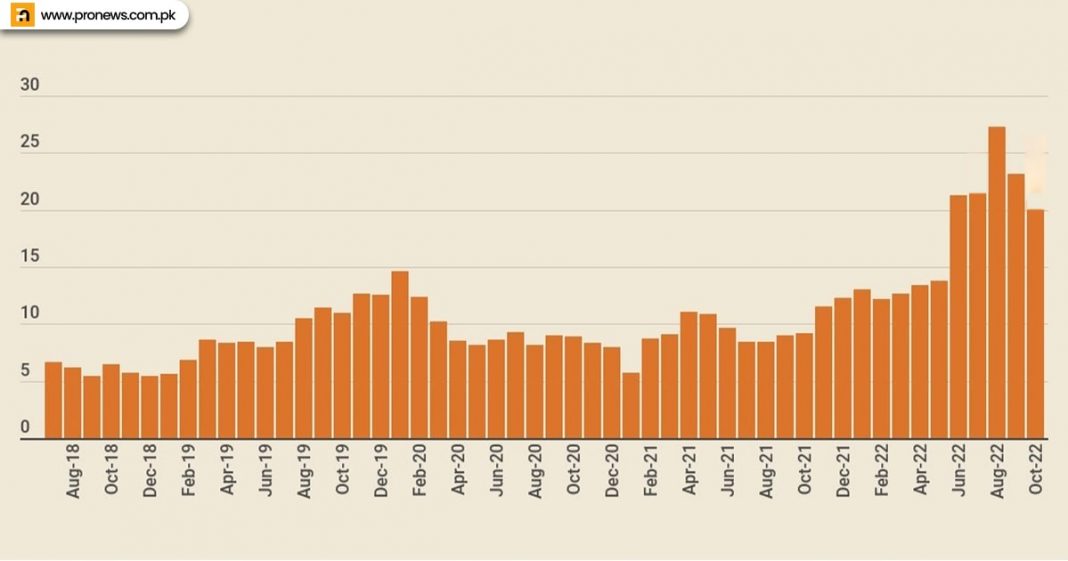

KARACHI (Pro News): State Bank Of Pakistan permitted cash brokers to sell up to 20% of workers’ repayments sent home by another country Pakistanis to address the lack of US dollars in the open market, said the Exchange Companies Association of Pakistan (ECAP) on Thursday. These findings are in peril of pushing down the dollar rate in the forex market.

Key points

- Firms predicted getting half of the settlements would reduce the dollar’s pay.

- Afghan people hold billions of rupees.

- Malik Bostan made an impression on Pakistan’s cash.

Details

The State Bank of Pakistan (SBP) had bound cash transporters to surrender 100% of workers’ repayments in the between-bank market, giving almost nothing to the vendors to propose to individual clients.

SBP Lead delegate Jameel Ahmed arranged a social gathering. In the meeting, ECAP President Malik Bostan explained Afghanistan’s affiliation gave a circumlocutory empowering its occupants and vendors to change over Pakistani cash open with them into US dollars and other new money-related guidelines.

Also Read About: Expensive crude is influencing the global recession on our economy

Afghan people carry billions of rupees. “Their change into the US dollar has caused the rupee’s destroying, as the Afghans are changing over the cash through Pakistani business districts in line region (across Durand Line),” he granted, according to an ECAP explanation.

Malik Bostan made a vibe about Pakistan’s cash

The US dollar value in Pakistani rupees is higher by Rs10-15 in line regions that stood, separated from the rate in Karachi. Hawala-Hundi (reference) structure heads and merchants are recreating with Pakistani cash.

“Afghanistan is stinking around $2 billion reliably from Pakistan’s stores,” he added.

Pakistani cash stayed aware of its rut for the second continuing on a working day as it fell by 0.23% (or Rs0.52) to close at Rs221.95 against the US dollar in the between bank market.